Your surcharge solution calculates the value of the surcharge for you and automatically adds it to the transaction when your customer taps, swipes or inserts their credit card or smart device

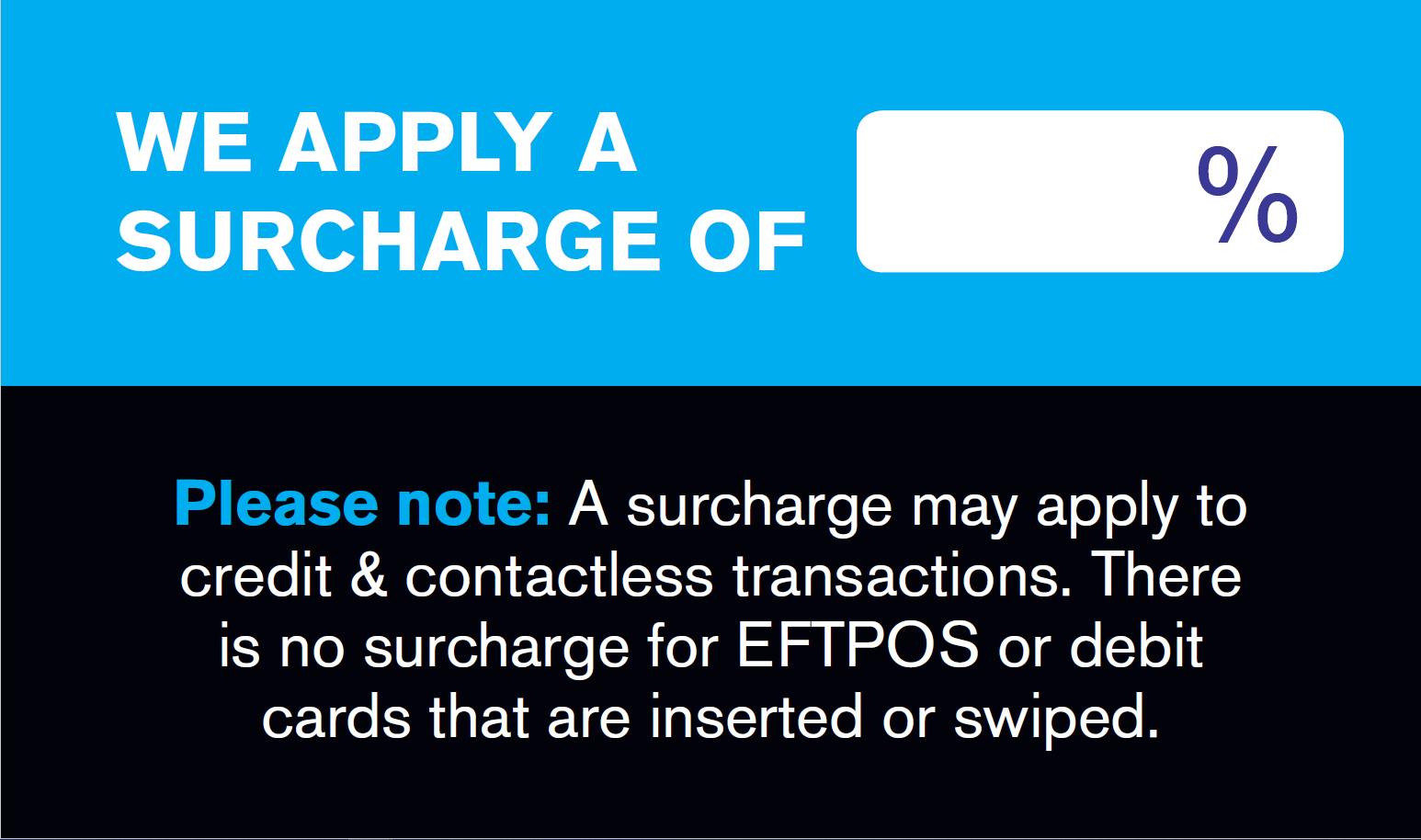

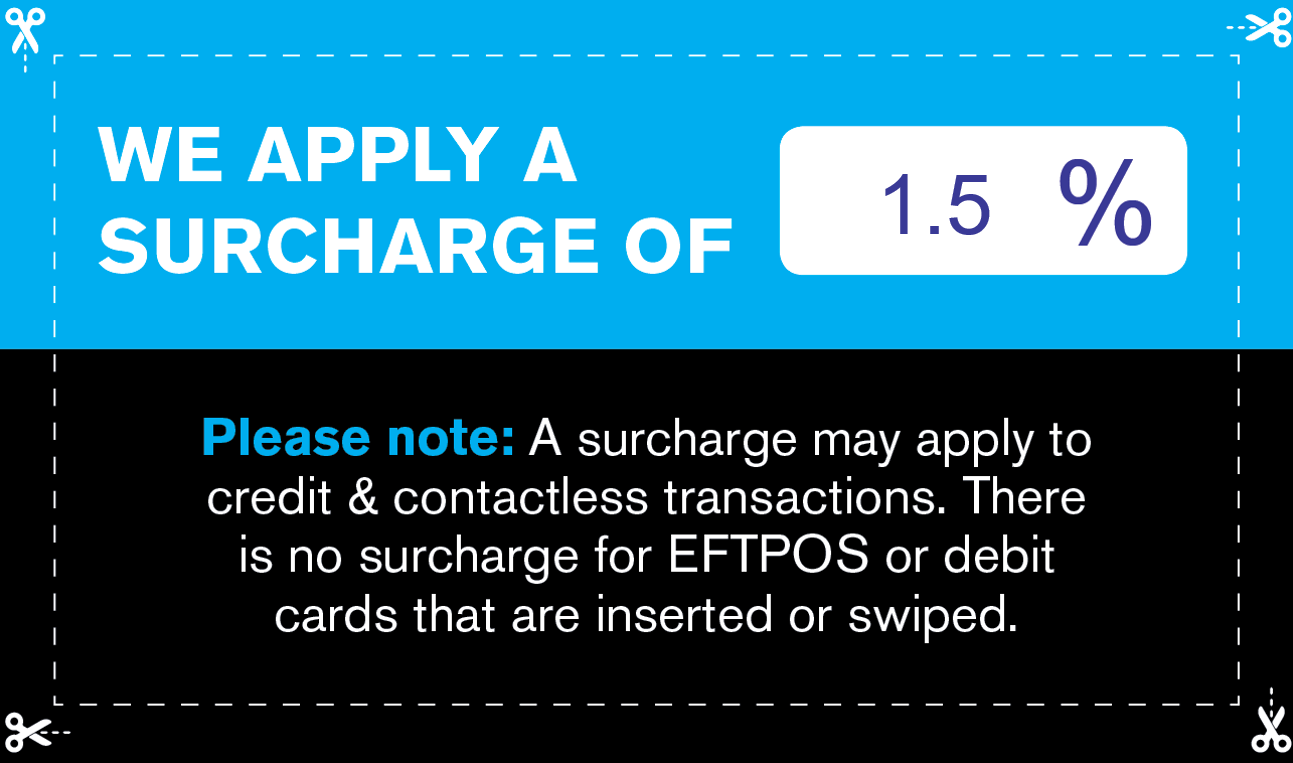

Apply a surcharge to credit & contactless transactions

Apply a surcharge to credit & contactless transactions

Offer the flexibility of more payment options without increasing your costs.

Your surcharge solution calculates the value of the surcharge for you and automatically adds it to the transaction when your customer taps, swipes or inserts their credit card or smart device

There are legal obligations you must meet if you add a surcharge to your normal prices. The Eftpos New Zealand Surcharge Fee Solution takes care of some of these obligations for you, but it is important that you read and understand the full terms and conditions.

Get credit card surcharging for $10.00 + GST per terminal, per month and save hundreds of dollars in merchant fees by passing the cost of acceptance on to your customers who choose to pay by credit card.

Differential surcharging allows you to apply a lower surcharge rate to these contactless debit transactions, helping you pass on the cost of acceptance more accurately and fairly to your customers. Learn more here.

The prompt to accept the surcharge is optional for contactless transactions.

MOTO Surcharge Override is an optional add-on for businesses that accept MOTO transactions. When the override is enabled, your terminal will prompt you to choose whether to apply a surcharge to your Manual/MOTO transactions. Learn more here.

.jpg)

If you have surcharging enabled your present card screen will display a message that says 'Surcharge May Apply'. When a customer selects the credit option during a purchase transaction or taps a smart device to make a payment, an additional prompt appears notifying them a surcharge is going to be applied*. If the customer accepts the surcharge the transaction proceeds and the terminal will automatically apply the surcharge for you.

*The surcharge prompt can be removed for contactless transactions.

In New Zealand, merchants can legally pass on the cost of their Merchant Service Fees (or MSF) for accepting certain payment methods to the cardholder at the point of purchase. This includes payments made using Visa, Mastercard, UnionPay, AMEX, and JCB cards and mobile wallets including payWave (Visa), Tap & Go (Mastercard), Apple Pay and Google Pay.

Our new Android devices can apply a surcharge to transactions made with a contactless card or device so you can recoup the cost of offering this convenient payment method