Offer more payment options without increasing your costs

Cost savings

Customisable

Customer choice

Accept more payment methods without increasing your expenses

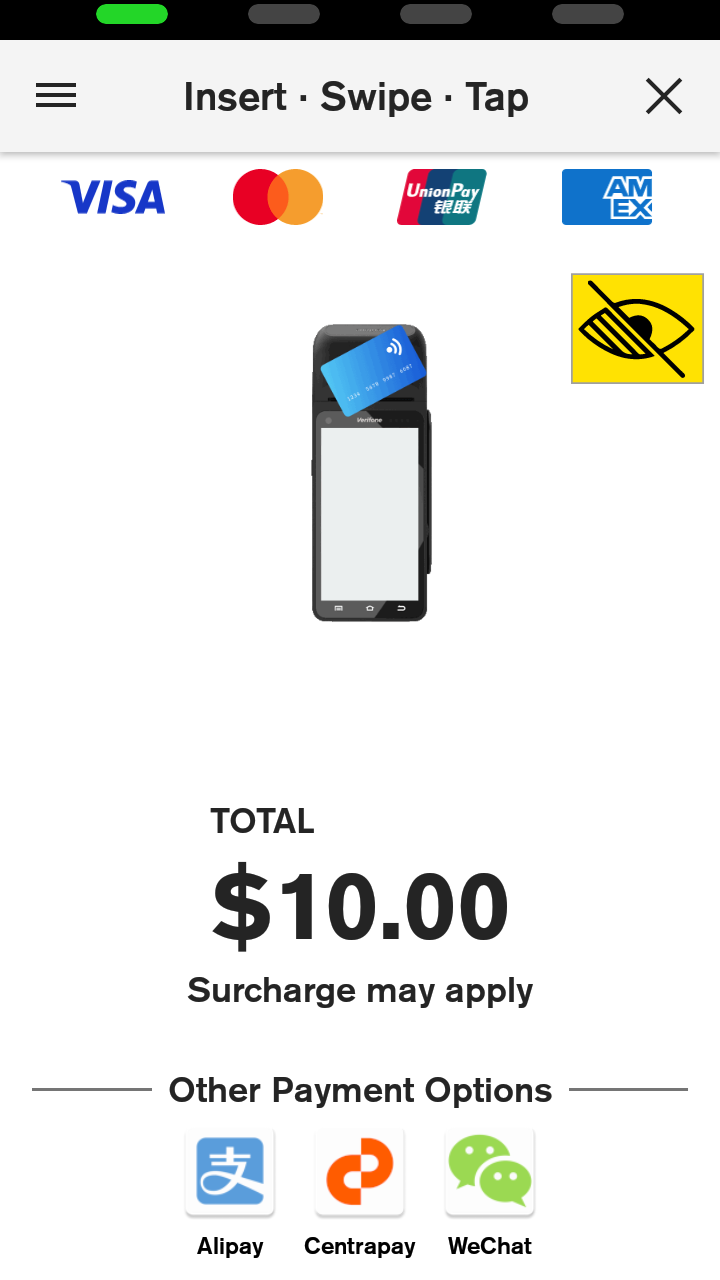

Let your terminal do the work

Eftpos NZ terminals automatically add the right surcharge to card transactions, so staff don’t need to calculate anything. The surcharge is clearly displayed on-screen before the customer accepts and completes their payment.

.jpg)

Accept more payments without extra costs

Don’t limit your customers’ payment options. Surcharging lets you accept more cards and contactless payments without adding to your expenses. Customers enjoy choice, and with transparent surcharges, they always know what they’re paying.

Fully customisable

Set surcharges based on transaction value, define minimum or maximum amounts, skip the acceptance prompt for contactless payments, and choose whether to apply surcharges to MOTO transactions.

Guide to the Surcharge Ban

How it works

Notification

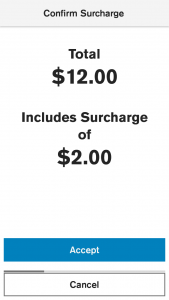

Customer Accepts Surcharge

Transaction Processed

Resources

Credit card surcharging: Your merchant obligations

FAQs: Credit Card and Contactless Surcharging

How to Create a Surcharge Report in Verifone Central

Frequently Asked Questions

How does it work?

Your EFTPOS terminal automatically applies the surcharge to eligible transactions. The amount is shown on-screen, and the customer must accept before paying.

Which transactions can I surcharge?

You can apply surcharges to credit, debit, and contactless transactions. MOTO (manual) transactions can also be surcharged.

How much should I surcharge?

Your surcharge should reflect the cost of acceptance for each payment type. This varies depending on your merchant service provider’s fees.

Can I turn surcharging on and off?

Surcharging can be enabled, adjusted, or disabled at any time, but you cannot turn surcharging off on a per-transaction basis (except for MOTO transactions)

Are there legal requirements for surcharging?

Yes. Surcharges must not exceed the cost of acceptance as defined by the Commerce Commission. Learn more about obligations here.